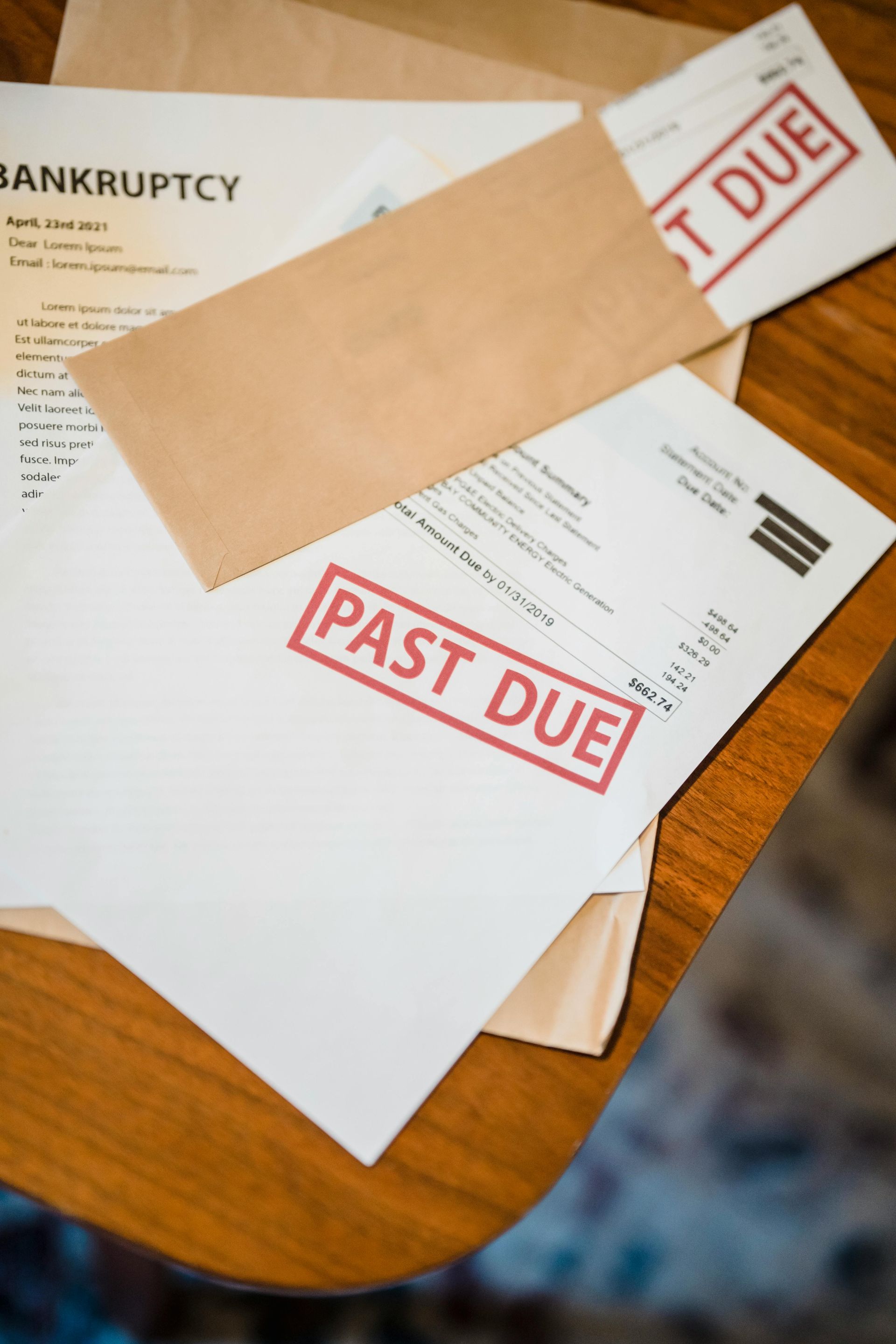

Find Relief from Financial Stress

Explore Our Bankruptcy filing Services in the Oklahoma City area

When financial burdens become overwhelming, you need a trusted guide to navigate the complexities of bankruptcy law. In Moore and Yukon, Ryan P. DeArman, P.L.L.C. offers personalized guidance to bankruptcy filing. Whether you're considering Chapter 7 to discharge debts or Chapter 13 to reorganize them, our attorney will work to provide the relief you need.

Our commitment to you includes a comprehensive approach that addresses your unique financial circumstances. We understand the stress that debt can cause, and our goal is to alleviate it through effective legal strategies. With the help of a bankruptcy attorney, you can regain control of your finances and start anew. Let us be your partner in this journey, providing the tools and support necessary to achieve financial stability.

Contact us to start your path to financial freedom.

What to Expect When You Hire US

When you choose our services, you can expect a thorough consultation to understand your financial situation. We take the time to explain your options clearly and help you decide the best course of action. Our process is designed to be supportive and stress-free:

Schedule a consultation to explore your bankruptcy options today.

Initial consultation to assess your financial situation

Detailed explanation of Chapter 7 and Chapter 13 options

Preparation and filing of all necessary documents

Representation at court hearings and meetings

Ongoing support throughout the bankruptcy process